Streamline. Automate. Settle.

Revolutionize your mortgage workflow with AI-driven precision.

Turn manual data entry into "Ready to Process" in seconds, not hours.

Express Documentation

Our team know how important customer service and turnaround time are, we ensure our documentation is sent within 24 hours from instruction.

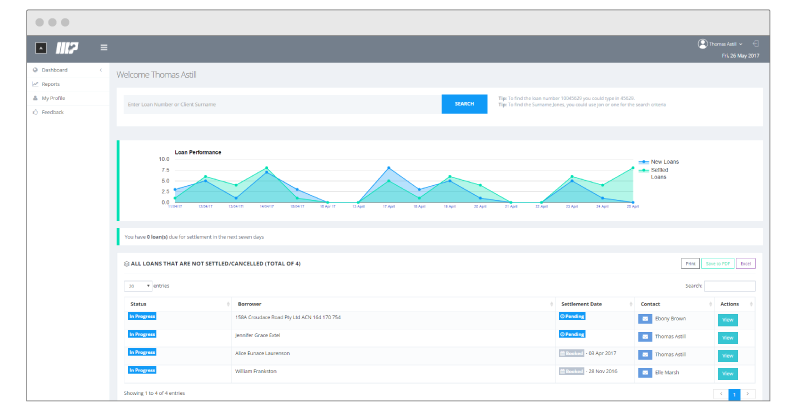

Live Loan Tracking

With the advantage of the digital age we provide full transparency via live data sharing on our loan tracking platform.

Analytics & Reporting

From automated reports to custom analytics, we provide it all and if you need a tailored report we are always open to implementation.

Compliant & Secure

As a Law Firm we understand the importance of data security and legal compliance for your Clientelle, our portal is encrypted via a 256bit SSL Certifice.

Morty AI

Intelligent Data Validation

The Foundation of Accuracy

We don't just read documents; we understand them. Our AI extracts essential data from client PDFs to mark matters as "Ready to Process."

- Smart Extraction: Automates the reading of complex PDF instructions.

- Dynamic Fee Guardrails: Cross-references extracted data against a live disbursement schedule.

- Risk Elimination: Real-time reconciliation prevents omissions that delay settlement.

Smart Document Generation

Perfect Packs, Every Time

Forget manual assembly. The system identifies the exact loan pack required based on lender, loan type, and security structure, then builds it instantly.

- Dynamic Merging: Selects the correct clauses and terms automatically.

- Context-Aware: Inserts borrower-specific data into the correct fields instantly.

- Compliance First: Tailors documents in real-time to meet regulatory standards.

Automated Execution Setup

Seamless DocuSign Integration

Transition from generation to signing without lifting a finger. The AI determines the delivery method (e-sign vs. wet) and automates the entire DocuSign setup.

- Auto-Tagging: Automatically places signature, initial, and date fields.

- Role Assignment: Assigns Borrowers, Guarantors, and Witnesses correctly.

- Smart Sequencing: Enforces the legal signing order automatically.

Consistency. Compliance. Speed.

ABOUT US

Mortgage Power advanced software systems was originally developed back in 2005 for our Lenders. Since then the software has grown continously to become the leader in Mortgage Processing software.

The Firm behind the system

Build by Astill Cronin Lawyers to cater for its high volume Lenders, Astills pioneered the implementation of bespoke software for Mortgage Processing. Bringing together over 40 years of established legal experience and technology to form the foundation of Mortgage Power.

Forward Thinking

By working closely with the needs of Lenders and Mortgage Managers our systems are constanly evolving to provide some of the most seamless integrations between Solicitor and Lender.

Intuitive and Intelligent Systems

By taking advantage or inteligent machine learning processes and communicating directly with your data via our bespoke API we are able to manipulate our system architecture to work directly with you.

These API’s will empower major savings in mortgage document processing to the benefit of you as the lender and the borrower as the end user.

It comes at no surprise our Clientelle are jumping at the opportunity work with us in this sector.

Get in Touch

Address

Please contact our head office via the following details:

-

1300 663 630

-

lawyers@astillcronin.com.au

-

Level 9, 50 Cavill Avenue, Surfers Paradise QLD 4217

-

PO Box 2345

Surfers Paradise QLD 4217